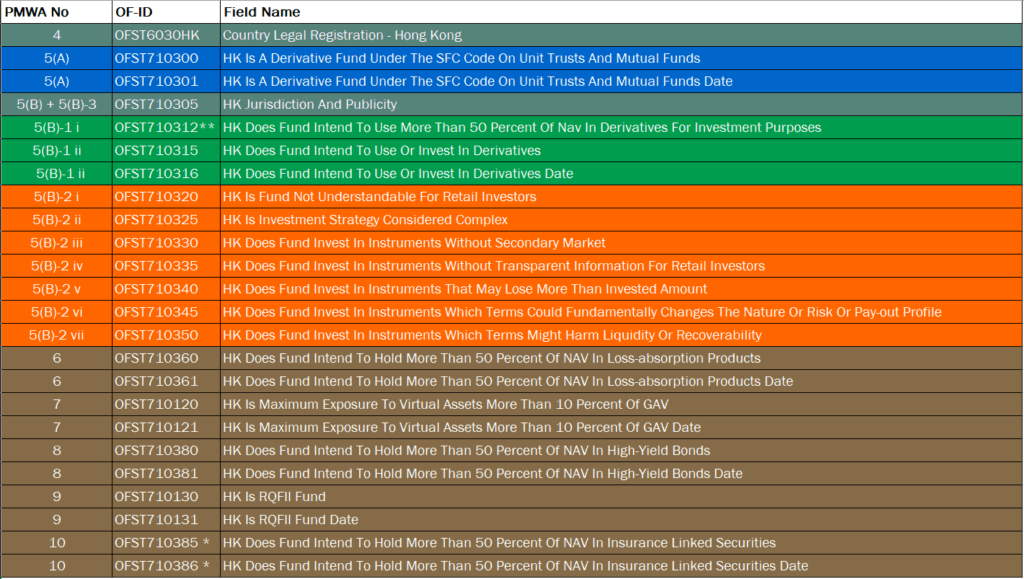

| OFST710300 | HK Is A Derivative Fund Under The SFC Code On Unit Trusts And Mutual Funds |

| OFST710301 | HK Is A Derivative Fund Under The SFC Code On Unit Trusts And Mutual Funds Date |

| OFST710305 | HK Jurisdiction And Publicity |

| OFST710312 ** | HK Does Fund Intend To Use More Than 50 Percent Of Nav In Derivatives For Investment Purposes |

| OFST710315 | HK Does Fund Intend To Use Or Invest In Derivatives |

| OFST710316 | HK Does Fund Intend To Use Or Invest In Derivatives Date |

| OFST710320 | HK Is Fund Not Understandable For Retail Investors |

| OFST710325 | HK Is Investment Strategy Considered Complex |

| OFST710330 | HK Does Fund Invest In Instruments Without Secondary Market |

| OFST710335 | HK Does Fund Invest In Instruments Without Transparent Information For Retail Investors |

| OFST710340 | HK Does Fund Invest In Instruments That May Lose More Than Invested Amount |

| OFST710345 | HK Does Fund Invest In Instruments Which Terms Could Fundamentally Changes The Nature Or Risk Or Pay-out Profile |

| OFST710350 | HK Does Fund Invest In Instruments Which Terms Might Harm Liquidity Or Recoverability |

| OFST710360 | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In Loss-absorption Products |

| OFST710361 | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In Loss-absorption Products Date |

| OFST710120 | HK SFC Is Maximum Exposure To Virtual Assets More Than 10 Percent Of GAV |

| OFST710121 | HK Is Maximum Exposure To Virtual Assets More Than 10 Percent Of GAV Date |

| OFST710380 | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In High-Yield Bonds |

| OFST710381 | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In High-Yield Bonds Date |

| OFST710130 | HK Is RQFII Fund |

| OFST710131 | HK Is RQFII Fund Date |

| OFST710385 * | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In Insurance Linked Securities |

| OFST710386 * | HK Does Fund Intend To Hold More Than 50 Percent Of NAV In Insurance Linked Securities Date |

* These fields were added in a later version of openfunds to the rest of the fields (v1.28). As such, it is expected that coverage of this data will be lower for users.

** This field was added in openfunds v2.0 to replace the previous field OFST710310 HK Has Fund Used Derivatives For Investment Purposes

Requirement of the Securities and Futures Commission (SFC)

According to the SFC Platform Operators should determine whether an overseas product is complex or non-complex with regards to paragraph 6.1 of the Guidelines on Online Distribution and Advisory Platforms. A non-exhaustive list of examples of investment products that are considered to be non-complex can be accessed here. For offline transactions, intermediaries should also consider the list of examples and the paragraph 5.5 of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission to determine whether an overseas product is complex or non-complex.

Guidance for the use of the openfunds fields

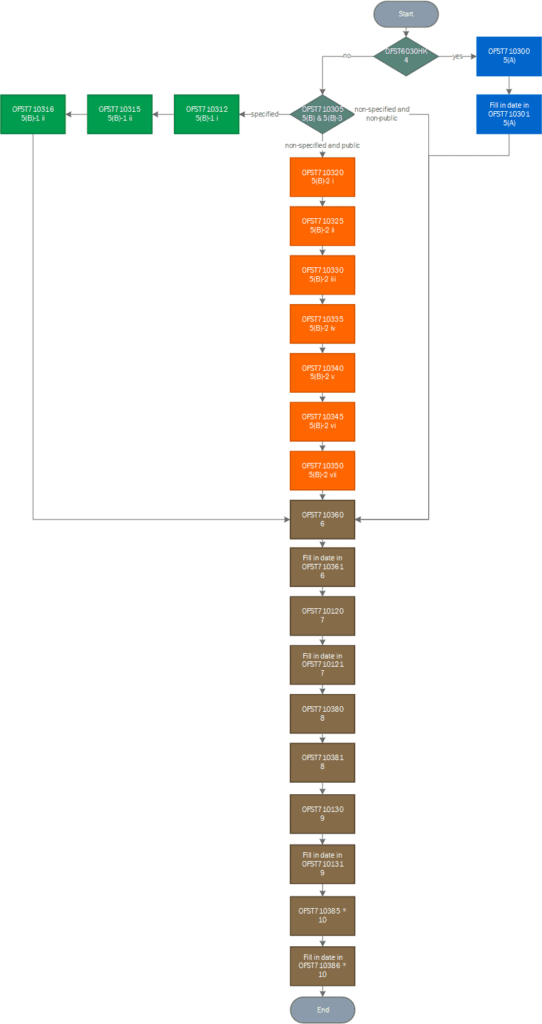

The above mentioned fields can be used by a Platform Operator to determine if a fund is a complex or a non-complex fund. The following flowchart shall help the Fund Houses to decide which fields should be filled in.

If the value of the field “OFST6030HK Country Legal Registration – Hong Kong” is “yes”, then the blue marked fields (OFST710300 and OFST710301) must be filled in. In addition, the brown marked fields must be filled in as well. The fields in green and orange should be left blank.

If the value of the field “OFST6030HK Country Legal Registration – Hong Kong” is “no” then the field “OFST710305 Jurisdiction And Publicity” must be filled in while the blue fields should be left blank. Depending on the value, the following fields have to be populated:

- The value of “OFST710305” is “specified”: The green marked fields and the brown must be filled in. The orange and the blue fields should be left blank.

- The value of “OFST710305” is “non-specified and public”: The orange marked fields and the brown fields must be filled in. The green and the blue fields should be left blank.

- The value of “OFST710305” is “non-specified and non-public”: Only the brown marked fields must be filled and the other fields (green, orange and blue) should be left blank.

Depending on which path is the right one for a fund, the blue, green or orange fields must be filled in. Regardless of whether the blue, green or orange fields must be completed or left blank, the brown fields must be populated.

Document Information

|

Title: |

Hong Kong Complex And Non-complex Funds |

|

Language: |

English |

|

Confidentiality: |

Public |

|

Authors: | openfunds, Garie Ho |

Revision History

|

Version |

Date |

Status |

Notice |

| 1.2 | 2024-03-08 | Final | Updated for v2.0 of openfunds |

|

1.1 |

2022-03-21 |

Final |

Updated for v1.28 of openfunds |

|

1.0 |

2019-08-22 |

Final |

|

Implementation

If you have any questions about the new data type or difficulties with implementation please contact us at businessoffice@openfunds.org.

Joining openfunds

If your firm has a need to reliably send or receive fund data, you are more than welcome to use the openfunds fields and definitions free-of-charge. Interested parties can contact the openfunds association by sending an email to: businessoffice@openfunds.org

openfunds.org

c/o Balmer-Etienne AG

Bederstrasse 66

CH-8002 Zurich

Tel.: +41 44 286 80 20

Email: businessoffice@openfunds.org

If you wish to read or download this white paper as PDF, please click here.